Cash 4 You® is recognized as Ontario’s Top Rated Local® money solutions retailer, because we’re passionate about helping hardworking Canadians just like you achieve their financial goals. As a leading moneylender for personal loans such as installment loans, we want to help you improve your credit score and your financial standing so that you can live the life you want. That’s why, along with our loans, we’re proud to offer simple and effective credit-building solutions through myCreditBoost™. This benefit is simply an extension of your loan that is designed to help you improve your credit score over time through a sensible credit-builder loan system that really works. In fact, more than 67% percent of our customers have boosted their credit score within six months of taking out a loan with the benefit of the myCreditBoost built-in to your loan terms. But how does this benefit work? It’s simple! Let us explain.

myCreditBoost™: A Sensible Credit Building Solution for You

Here at Cash 4 You, we do things a little differently. We understand that there is a lot more to your financial profile than just your credit score. By the same token, we also understand the importance of your credit score for achieving various financial goals in your life.

From buying a car to purchasing a home, your credit score has a major impact on your purchasing power. We’re dedicated to helping our customers make a positive impact on their financial standing, which is why you can count on our money solutions to help you build your credit.

How to Build Credit 101: All About myCreditBoost™

myCreditBoost™ is an ideal credit building solution for people who score lower on the credit spectrum, or for anyone who wants to build and strengthen their current credit standing — simply by making on-time payments to their installment loan.

Take Your Credit to the Next Level

We understand that you are more than just a number, and you should not be held back from achieving your personal and financial goals just because your credit history is less than satisfactory. That’s why Cash 4 You is proud to work with people of all credit standings and from all walks of life. Through myCreditBoost™, we are able to help you build your credit score by way of a personalized plan and loan repayment terms that are sensible, affordable, and hassle-free. Our goal is to help you not only improve, but also maintain and protect your credit score, so that you have a solid foundation to build a strong financial future. What’s more, we’re happy to say that building your credit has never been easier. Check it out!

We understand that you are more than just a number, and you should not be held back from achieving your personal and financial goals just because your credit history is less than satisfactory. That’s why Cash 4 You is proud to work with people of all credit standings and from all walks of life. Through myCreditBoost™, we are able to help you build your credit score by way of a personalized plan and loan repayment terms that are sensible, affordable, and hassle-free. Our goal is to help you not only improve, but also maintain and protect your credit score, so that you have a solid foundation to build a strong financial future. What’s more, we’re happy to say that building your credit has never been easier. Check it out!

How myCreditBoost™ Works

By taking advantage of this personalized credit-building loan benefit, you can make a positive impact on your credit score and strengthen your credit history by making on-time repayments on your personal loans. Here’s how it works:

Apply for an Installment Loan

First things first, you will want to apply for a stress-free installment loan in amounts ranging from $1,000 and $15,000. To do this, all you need to do is stop by one of our 100-plus locations in an Ontario city near you. If you prefer to start the application online, you can simply visit Cash 4 You to get started. Simply connect with Cash 4 You to determine your eligibility for a loan. The good news is, we have relaxed credit requirements, we work with most credit situations, and we always look at more than just your credit score. We will check your general information such as your age, residency status, your employment status, and whether or not you have an open, active bank account. Additionally, one of our helpful customer care associates will make a hard inquiry on your credit report in order to determine your eligibility for an installment loan.

But don’t worry! Unlike other types of loans offered through banking institutions, we make getting approved quick and easy. There are no flaming hoops to jump through, and we’ll approve your loan the same day you apply.

If you already have a loan with Cash 4 You, congratulations! All you have to do is continue making timely payments on your loan according to the agreed-upon terms and conditions of your specific loan. Then, continue making on-time payments each and every month to help build your credit score and strengthen your overall credit history. It really is that easy!

Enjoy the Benefits of myCreditBoost™

If you are eligible for an installment loan of up to $15,000, and once you have accepted the terms and conditions of the loan, you can start enjoying all of the benefits of myCreditBoost™. It’s an easy and effective way for you to begin your journey toward building a strong financial future for yourself and your family. What’s more, you get the funds you need to cover large expenses and big purchases without the rising interest rates associated with high-interest credit cards.

Make Your Regularly Scheduled Loan Payments

The myCreditBoost™ benefit is based on installment loans you have with Cash 4 You. The goal is to repay your personal loan according to the agreed-upon terms of your loan. By making your regularly scheduled loan payments on-time based on your pay frequency (weekly, bi-weekly, semi-monthly, monthly) throughout the course of your loan terms, you can be well on your way to building your credit.

Accumulate Positive Marks on Your Credit History

Once you begin making payments on your installment loan, we note each payment in our system. Unlike some lenders, Cash 4 You reports to major credit bureaus, like Equifax and TransUnion, meaning we will alert these major credit bureaus of each and every on-time payment you make. As you make payments and we report them to the credit bureaus, you can begin accumulating positive marks on your credit history, thereby building a positive “credit reputation,” so to speak. These positive marks can improve your credit score over time throughout the length of your loan terms (up to 60 months).

*It is important to note that any late or missed payments could negatively affect your credit report. If you ever miss a payment, it is essential to your credit history that you make up this payment immediately. Your best bet is to connect with our customer care team right away to explore your options. We are here for you and we want to help you continue making a positive impact on your credit score.

FAQs: Understanding Your Credit

Now that you have an idea of how myCreditBoost™ works, let’s explore why this program is so beneficial for anyone looking to improve their credit standing.

What Is a Credit Score?

Your credit score is a three-digit number that reflects your financial activity and standing with regard to various types of credit and financial accounts, including credit cards and personal loans such as installment loans. Financial lenders, employers, and others can use this number to determine a person’s credit risk, which can influence

What is a Good Credit Score?

What is a Good Credit Score?

The highest credit ranking is a 900 in Canada, and generally, anything above 700 is great. A score of 600 is considered good, but this score can make it challenging to qualify and get approved for new credit. What’s more, your interest rates on most loans and credit cards will typically be much higher if your score drops below 660. Talk to Cash 4 You about an installment loan of up to $15,000; we work with people of all credit standings!

What is a Poor Credit Score?

The lowest credit score dips to 300, although it is rare for people to have that low of a score. Generally speaking, credit scores below 580 are considered to be poor credit. For people with poor credit scores, it can be difficult to get financed for personal loans (unless it’s through Cash 4 You), home loans, car loans, and can even make it challenging to lease a home.

What Is a Credit Report?

Your credit report is similar to that of a highly detailed, financially focused report card that outlines all of your financial history and activity. This report shows your credit score as well as a detailed breakdown of your loans, credit cards, and other financial creditors. Additionally, your credit report shows your payment history, including on-time payments, missed payments, delinquencies, paid/closed accounts, foreclosures, bankruptcies, lawsuits, and anything else pertaining to your financial record.

How Long Does Information Stay on My Credit Report?

Typically, once you open a new account, positive data stays on your report for about 10 years. On the flip side, negative marks on your credit report usually go away after about seven years. However, if you have a bankruptcy, this information can stay on your report for as long as 10 years.

What is the Difference Between Hard and Soft Credit Inquiries?

Checking your own credit report shouldn’t affect your credit score. In fact, it’s smart to check your credit score and history at least once a year, if not a few times a year. Similarly, when lenders run a soft inquiry on your credit, this means they are looking at your credit to get a baseline view of your credit history, but without involving a third party. On the other hand, hard inquiries can affect your credit score each time your credit is pulled from or reported to a third-party agency. Lenders run hard inquiries each time you apply for a credit card, personal loan, car loan, mortgage, and other types of loans or lines of credit. Generally, hard inquiries stay on your credit for approximately two years.

How to Build and Improve Your Credit Score

What Is a Credit Report?

What Is a Credit Report?

Along with the advantages you’ll enjoy by paying your loan installments on-time, there are many ways you can build your credit, and strengthen and maintain a positive credit score. Keep in mind that there are many aspects of your financial activity that can impact your credit standing, including:

- Payment History

- Owed Amounts

- Length of Credit History

- Types of Credit You Use

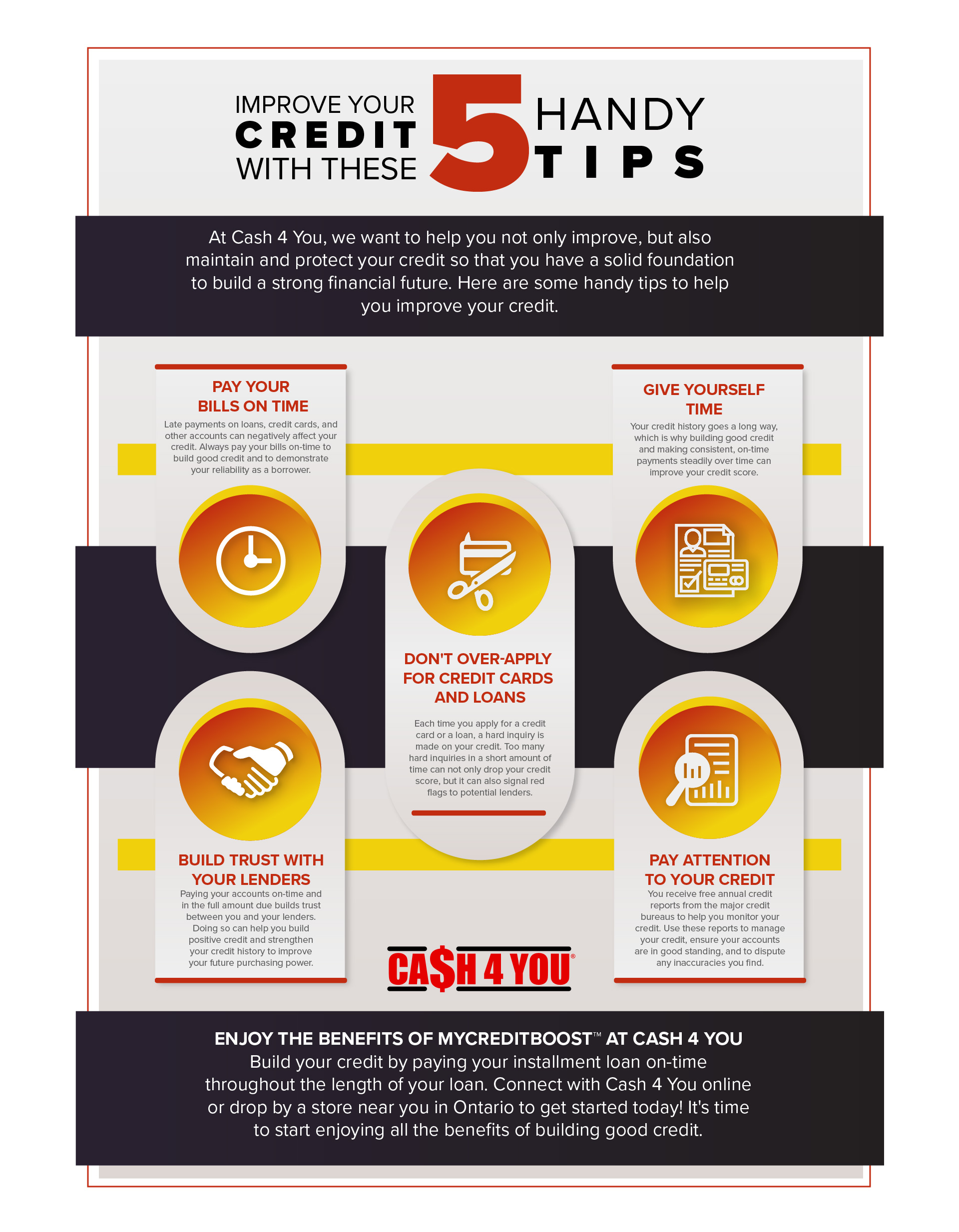

Here are a few handy tips to help guide you in building a strong financial record for yourself.

Take Out a Credit Building Loan

Credit building loans are one of the best ways to build your credit and get the money you need to fund all of life’s adventures. Here at Cash 4 You, we are recognized as a Top Rated National® money lender that has funded more than $1 billion in personal loans for hardworking Canadians in Ontario since 2001. From cash advance loans in amounts up to $1,500, to larger installment loans of up to $15,000, we are proud to offer our loans to people of all credit standings.

What’s more, we are passionate about helping our friends and neighbors all across Ontario with simple, sensible, stress-free money solutions. Through our personal loans, we can not only help you cover monthly expenses, make big purchases, and fund everything from dream vacations to weddings to home improvements and more, but we can also help you build your credit through payments made to your loan over time. Talk to a Cash 4 You lender about how you may benefit from an installment loan to build credit.

Make Timely Payments

Make Timely Payments

Punctuality is of the utmost importance if you want to improve your credit score and maintain a positive credit history. Whether your payments are a few days late, a month late, or longer, failing to pay your bills on time could negatively affect your credit for years to come. Generally, many lenders report late payments to major credit bureaus when they are received after the 30-day mark. Not only that, you will be charged late fees that can really hurt your pocketbook. On top of that, your interest rates can shoot up well past 20-30% or more.

Along with paying your loans and credit cards on time, it’s important to pay all of your bills on time, including cable, internet, utilities, and other monthly expenses. What’s more, late payments often lead to missed payments that can eventually turn a good-standing account into a delinquent one.

Here are some hints to consider if you’ve made late payments:

- If you’re in good standing with your bank or lender, you can request forgiveness and ask for a one-time removal of a late payment fee.

- If your interest rates go up, you can talk to your issuer and request to have your interest reset to the pre-penalty rate. You will need to make your payments on-time moving forward, but this a great option to try.

- If you get charged a late fee, or you see your interest rates go up, the best thing you can do is pay all of your accounts and your debts on-time moving forward. Paying your bills consistency can help you gradually improve your credit score over time.

Pay Down Your Debts

Pay Down Your Debts

Make paying down your debts a priority. Along with paying them on time, paying them off narrows the ratio between the amount of debt you owe, the amount of money you make, and the credit you have to work with. Paying off your debts shows lenders that you are not stretching yourself too thin with what you have borrowed and what you can afford to pay back.

Build Trust with Your Lenders

One way to improve your credit score is to build trust with your lenders and creditors. Making your loan payments on-time helps you stay consistent, which can positively affect your overall credit standing. Not only that, developing a good credit history will make it easier to get approved for future loans, and can help you move ahead with other financial endeavors.

Don’t Get Yourself in Over Your Head

Credit cards can be helpful, but they can also set you on the path to getting in way over your head. Be realistic with your borrowing. Don’t just open credit cards for the sake of opening them. Be intentional with your credit — and with your borrowing.

Make Smart Financial Decisions

The best thing you can do to build your credit score and maintain a healthy credit history is to do your due diligence in making smart financial decisions. Set a budget for yourself and stick to it. Avoid impulse or overspending. Spend within your means and don’t rely on high-interest credit cards to make purchases. Instead of making purchases with credit cards when you need extra money to get you through the month, or you want to make a large purchase or fund a big expense, explore your loan options. Instant cash loans and installment loans are a sensible money solution that can help fund the things you need without the high-interest rates of a credit card.

Be Mindful with Credit Cards

Opening too many credit cards at once, or within a short period of time, can negatively affect your credit score.

Think about it like this: anytime you apply for a new credit card, the lender will pull a hard inquiry on your credit, which we discussed in the FAQ section above. Hard inquiries can cause your credit score to drop, and too many hard inquiries in a short period of time can reflect negatively on your financial habits.

What’s more, maxing out your credit cards and/or only paying the minimum amount owed for the month can cause your credit rating to drop.

Check out these handy tips to help you be mindful of your credit card usage:

- Don’t open too many credit cards at once.

- If you want more than one credit card, space out the time in-between applying for credit cards to minimize the amount of consecutive hard pulls on your credit.

- If you make a purchase on your credit card, try to pay it off right away to avoid paying interest on a single purchase.

- Always pay more than the amount due on your monthly statement.

- Pay off your high-interest credit cards, and cards with smaller debt amounts, with a personal loan, such as an installment loan, that offers better rates, zero fees, and helps you build your credit.

- Put your credit cards on ice to help you pay down the debt accrued on your card.

Connect with Ontario’s Trusted Money Solutions Experts

If you are ready to boost your credit to the next level, there’s never been a better time to get started than right now. Our team of friendly and knowledgeable financial experts wants to help you get started down the path to improving your credit score and building a positive credit history. Getting started is fast, simple, and easy! Drop by one of our 100-plus stores conveniently located in cities all across Ontario, or hop online to apply for an installment loan. We are more than happy to help you build your credit so you can achieve your financial goals. Start enjoying all the benefits of myCreditBoost today!

If you are ready to boost your credit to the next level, there’s never been a better time to get started than right now. Our team of friendly and knowledgeable financial experts wants to help you get started down the path to improving your credit score and building a positive credit history. Getting started is fast, simple, and easy! Drop by one of our 100-plus stores conveniently located in cities all across Ontario, or hop online to apply for an installment loan. We are more than happy to help you build your credit so you can achieve your financial goals. Start enjoying all the benefits of myCreditBoost today!

Do you want to learn more ways you can improve your credit? Do you want to learn more about how our installment loans and other money solutions can help you build your credit? Be sure to subscribe to the Cash 4 You YouTube channel where you can watch insightful and entertaining videos offering handy money-saving tips, how to’s, information about our personal loans, and so much more!